- Home

- About us

- Courses

-

News

Others

- ما العملات المستقرة؟ وكيف يجري تنظيمها؟

- المركزي الصيني يواصل شراء الذهب للشهر العاشر على التوالي

- أسبوع حاسم للسياسة النقدية العالمية.. "الفيدرالي" يتأهب لأول خفض للفائدة في عهد ترمب

- الأسواق تترقب خفض الفائدة.. ورهانات صعود الأسهم والسندات تتراجع

- الأسهم الأميركية تبلغ قمة جديدة مع توسع توقعات خفض الفائدة

- بعد خفض الفائدة.. باول يوحد صف الفيدرالي وسط عواصف السياسة والاقتصاد

- آمال الأسواق تتعلق بمكالمة ترمب وشي اليوم.. وهذا كل ما تحتاج لمعرفته

- فقاعة الذكاء الاصطناعي محور نقاشات البنوك المركزية باجتماعات صندوق النقد

- الاقتصاد العالمي على صفيح ساخن بسبب رسوم ترمب والذكاء الاصطناعي والديون

- أميركا تصعّد المواجهة التجارية مع الصين قبيل قمة ترمب وشي

- أسهم آسيا تتراجع و"بتكوين" تهبط دون 86 ألف دولار وسط قلق الأسواق

- مخاوف فقاعة الذكاء الاصطناعي تحكم قبضتها على وول ستريت

- "بتكوين" تفقد ثلث قيمتها من ذروتها التاريخية

-

Education

- Currency Pair System in the Forex Market

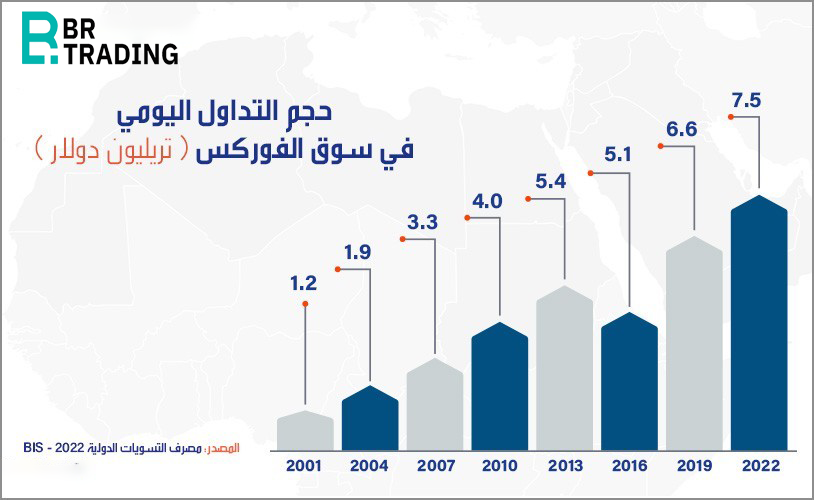

- Features and Characteristics of the Forex Market

- The Concept of Leverage and Its Sizes

- The Concept of Financial Markets

- What Is Margin and How Does It Work?

- Types of Forex Market Participants & Their Purposes:

- Swap Benefits or Rollover in Trading

- MetaTrader 4 Program Explanation

- Calculating the Point Value and Profit/Loss Calculation

- Types of Trading Orders in Forex

- Forex Trading Mechanism

- Trading Contracts in the Currency Market

- Understanding Price Movement in the Forex Market

- Understanding Forex Market Sessions and the Power of Liquidity Overlaps

- Top 8 Traded Currencies in the Forex Market and Their Global Impact

- Open Live Account

Category One: Speculative Traders (Profit-Seeking)

These are participants who trade for the purpose of making profits from rapid changes in currency prices.

They make up 91% of the total trading volume in the Forex market.

Examples include:

-

Major investment banks (core members of the Interbank network)

-

Hedge funds and investment funds

-

Asset management companies

-

Brokerage firms

-

Large individual traders

These participants aim to capitalize on price fluctuations for financial gains.

Category Two: Functional/Non-Speculative Traders

These participants trade currencies for purposes other than profit, such as travel or international trade.

They represent only 9% of the market's trading volume.

Examples include:

-

Central banks:

Engage in Forex to:-

Secure foreign currency reserves

-

Maintain exchange rate stability

-

-

Commercial companies (import/export firms):

Trade currencies to pay for goods and services across borders.

For instance, a U.S. company that wants to import goods from Japan must sell U.S. dollars and buy Japanese yen to settle the payment.

⏰ Forex Market Hours

The Forex market is a non-centralized, borderless market operating via various communication networks worldwide.

It does not have a physical location and is open 24 hours a day, 5 days a week:

-

Opens: Monday

-

Closes: Friday

-

Closed: Saturday & Sunday (global weekend break)

This round-the-clock operation allows traders from different time zones to participate at any time.