- Home

- About us

- Courses

-

News

Others

- ما العملات المستقرة؟ وكيف يجري تنظيمها؟

- المركزي الصيني يواصل شراء الذهب للشهر العاشر على التوالي

- أسبوع حاسم للسياسة النقدية العالمية.. "الفيدرالي" يتأهب لأول خفض للفائدة في عهد ترمب

- الأسواق تترقب خفض الفائدة.. ورهانات صعود الأسهم والسندات تتراجع

- الأسهم الأميركية تبلغ قمة جديدة مع توسع توقعات خفض الفائدة

- بعد خفض الفائدة.. باول يوحد صف الفيدرالي وسط عواصف السياسة والاقتصاد

- آمال الأسواق تتعلق بمكالمة ترمب وشي اليوم.. وهذا كل ما تحتاج لمعرفته

- فقاعة الذكاء الاصطناعي محور نقاشات البنوك المركزية باجتماعات صندوق النقد

- الاقتصاد العالمي على صفيح ساخن بسبب رسوم ترمب والذكاء الاصطناعي والديون

- أميركا تصعّد المواجهة التجارية مع الصين قبيل قمة ترمب وشي

- أسهم آسيا تتراجع و"بتكوين" تهبط دون 86 ألف دولار وسط قلق الأسواق

- مخاوف فقاعة الذكاء الاصطناعي تحكم قبضتها على وول ستريت

- "بتكوين" تفقد ثلث قيمتها من ذروتها التاريخية

-

Education

- Currency Pair System in the Forex Market

- Features and Characteristics of the Forex Market

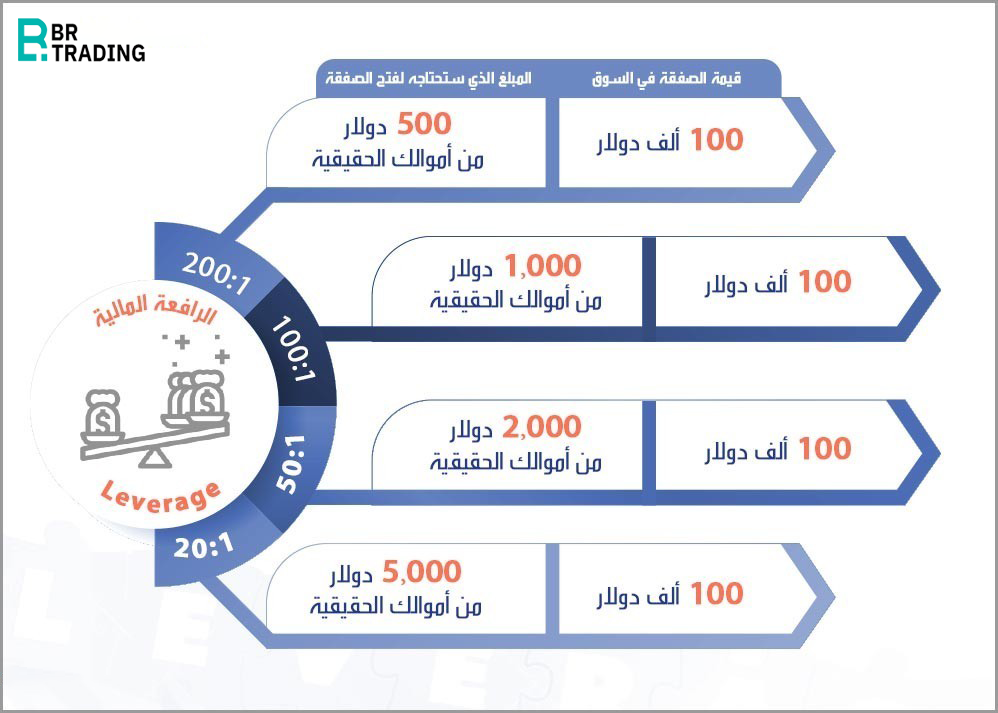

- The Concept of Leverage and Its Sizes

- The Concept of Financial Markets

- What Is Margin and How Does It Work?

- Types of Forex Market Participants & Their Purposes:

- Swap Benefits or Rollover in Trading

- MetaTrader 4 Program Explanation

- Calculating the Point Value and Profit/Loss Calculation

- Types of Trading Orders in Forex

- Forex Trading Mechanism

- Trading Contracts in the Currency Market

- Understanding Price Movement in the Forex Market

- Understanding Forex Market Sessions and the Power of Liquidity Overlaps

- Top 8 Traded Currencies in the Forex Market and Their Global Impact

- Open Live Account

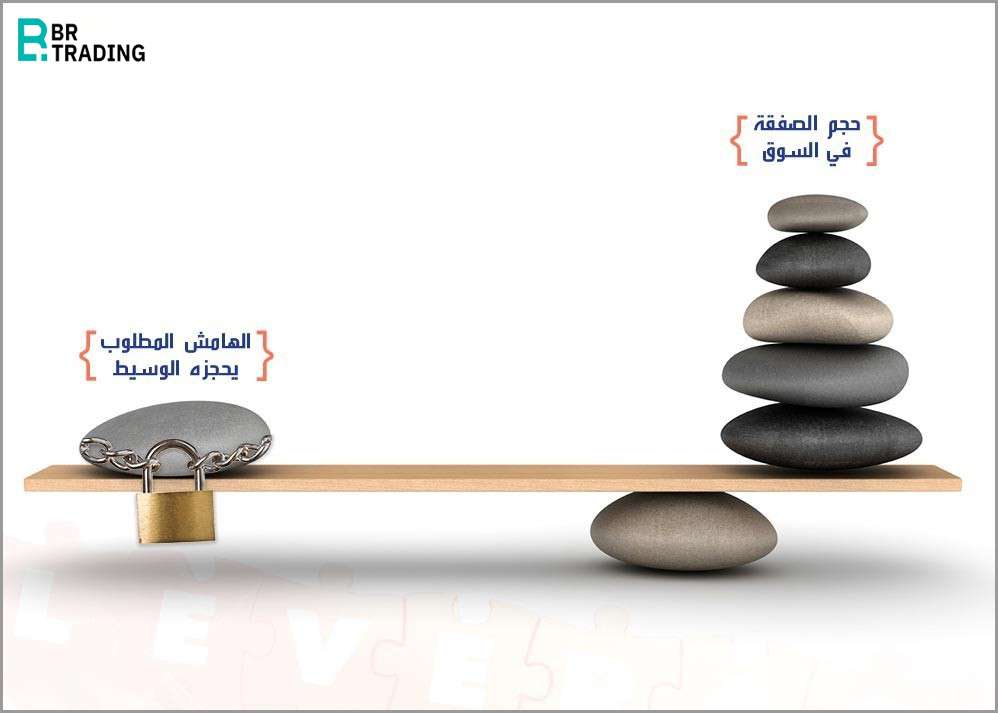

What Is Margin and How Does It Work?

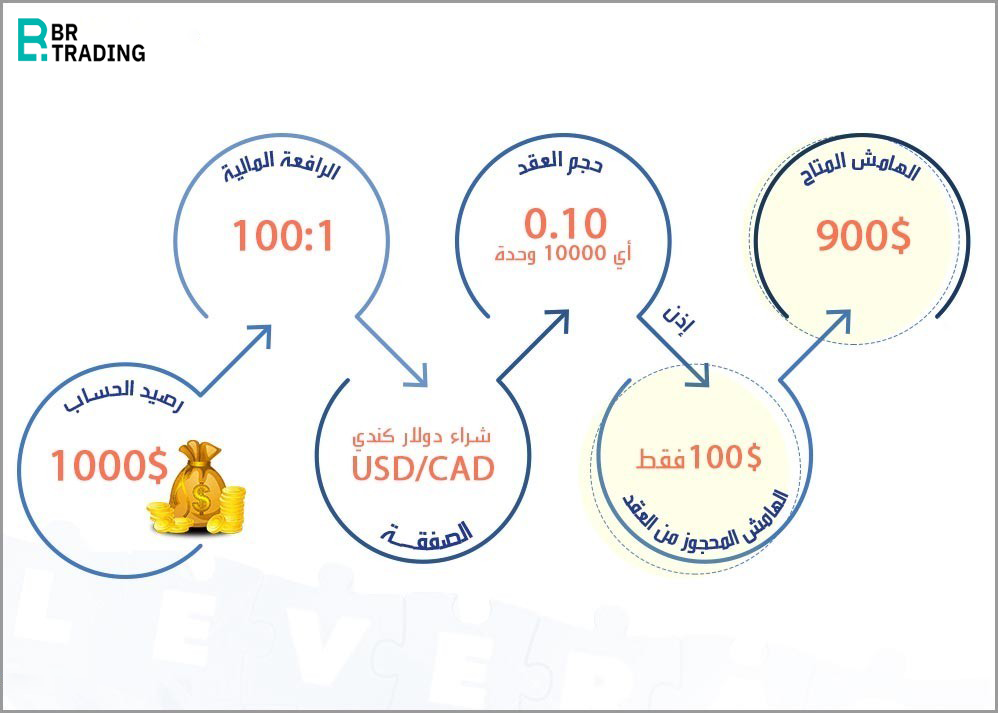

In the previous lesson, we talked about leverage, which is directly connected to the margin system. Let’s dive right into a practical example to explain how margin works:

Example:

Imagine you open an account with a brokerage firm and deposit $7,000. You are offered a leverage of 100:1. You decide to open a buy position in the market on the USD/JPY currency pair, with a trade size of $100,000.

-

Margin Required (Used Margin):

Since your leverage is 100:1, only 1% of the trade value is required from your account.

So, the broker will deduct $1,000 from your balance — this is called the used margin. -

Broker’s Contribution:

The broker contributes the remaining $99,000, which equals 99% of the trade value. -

Available Margin (Free Margin):

After the trade is opened, you still have $6,000 left — this is your free margin, or available margin.

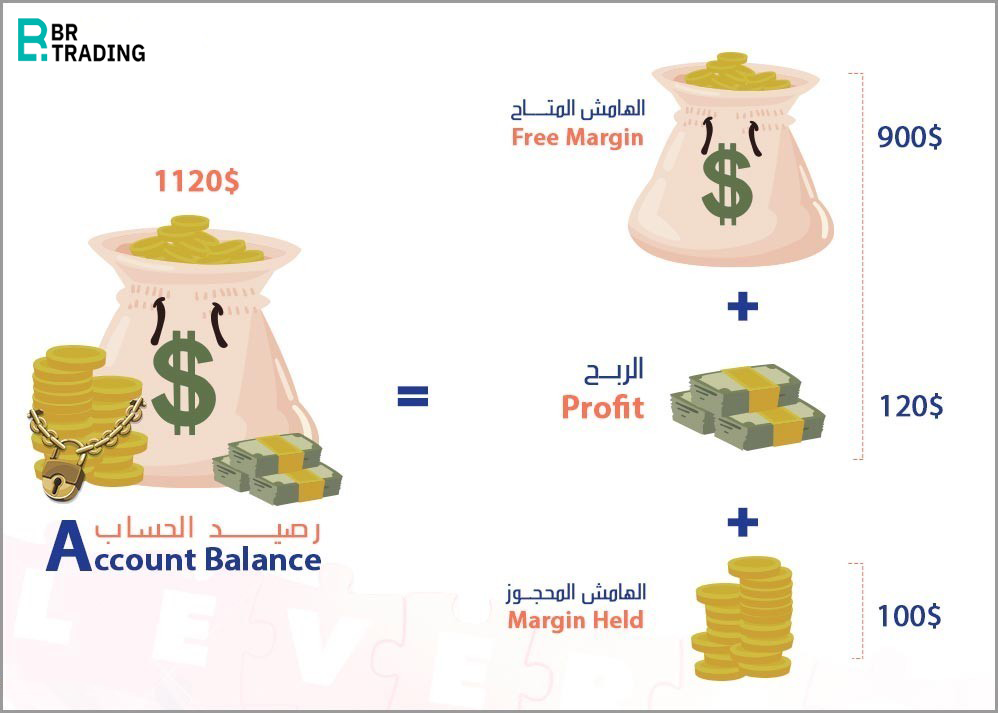

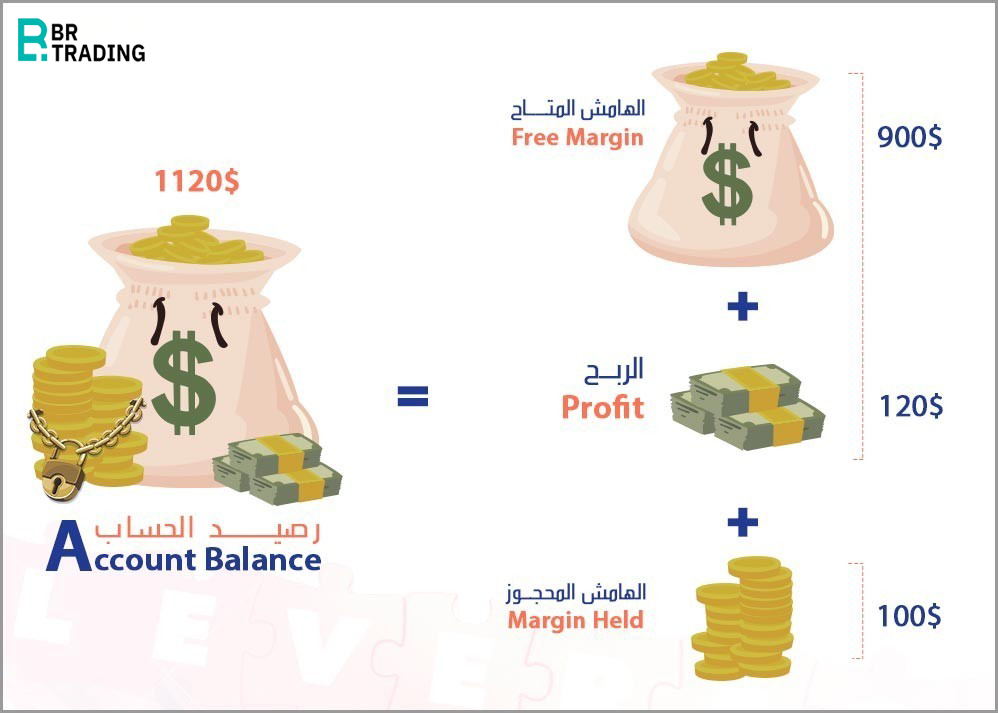

What Happens When the Market Moves in Your Favor?

Let’s say the trade goes in your favor and you gain $400:

-

Free Margin becomes $6,400

-

Used Margin remains $1,000

-

Equity (total account value including open trades) becomes $7,400

-

Account Balance still shows $7,000 until the trade is closed

Once the trade is closed, the balance updates to reflect the profit:

-

Final Balance = $7,400

What Happens If the Market Moves Against You?

Suppose the market moves against you and you lose $500:

-

Free Margin drops to $5,500

-

Used Margin stays at $1,000

-

Equity becomes $6,500

-

Account Balance remains at $7,000 (until the trade is closed)

If the trade is closed, the loss is realized:

-

Final Balance = $6,500

What If Losses Increase Further?

Let’s say the loss increases to $6,000, which equals your entire free margin:

-

Free Margin = $0

-

Used Margin = $1,000

-

Equity = $1,000

At this point, a Margin Call occurs.

What Is a Margin Call?

A Margin Call happens when your account no longer has enough free margin to support the open trade. The broker will automatically close your trade to prevent further losses, and your remaining balance will only be the used margin, i.e., $1,000.

This example illustrates the risk involved in leveraged trading and how quickly you can lose your capital if the market moves against your position.

Follow us in the next lesson to learn more about the Forex marke